The Definition – An Example of Discretionary Spending is _______.

An Example of Discretionary Spending is _______.

As an expert in personal finance, I understand the importance of making wise spending decisions. One area that often requires careful consideration is discretionary spending. Discretionary spend refers to the money we choose to allocate towards non-essential items or experiences. From dining out and entertainment to luxury purchases, discretionary spending can quickly add up and impact our overall financial well-being. In this article, I’ll delve into the concept of discretionary spend, its implications, and provide an example to help you better understand how it affects your financial goals.

When it comes to discretionary spending, it’s crucial to strike a balance between enjoying life’s pleasures and maintaining financial stability. While discretionary spend may seem harmless, it can have a significant impact on our long-term financial health. Understanding the difference between discretionary and essential spending is key to making informed financial decisions. In this article, I’ll explore the concept of discretionary spend, its potential pitfalls, and how to manage it effectively to achieve your financial goals.

In today’s consumer-driven society, it’s easy to get caught up in discretionary spending without realizing the long-term consequences. Discretionary spend refers to the money we choose to spend on non-essential items or experiences, and it can vary greatly from person to person. Whether it’s indulging in the latest gadgets, designer clothing, or extravagant vacations, discretionary spending can quickly become a drain on our finances. In this article, I’ll discuss the importance of being mindful of discretionary spending, provide an example to illustrate its impact, and offer practical tips on how to make smarter choices with your money.

What is Discretionary Spending?

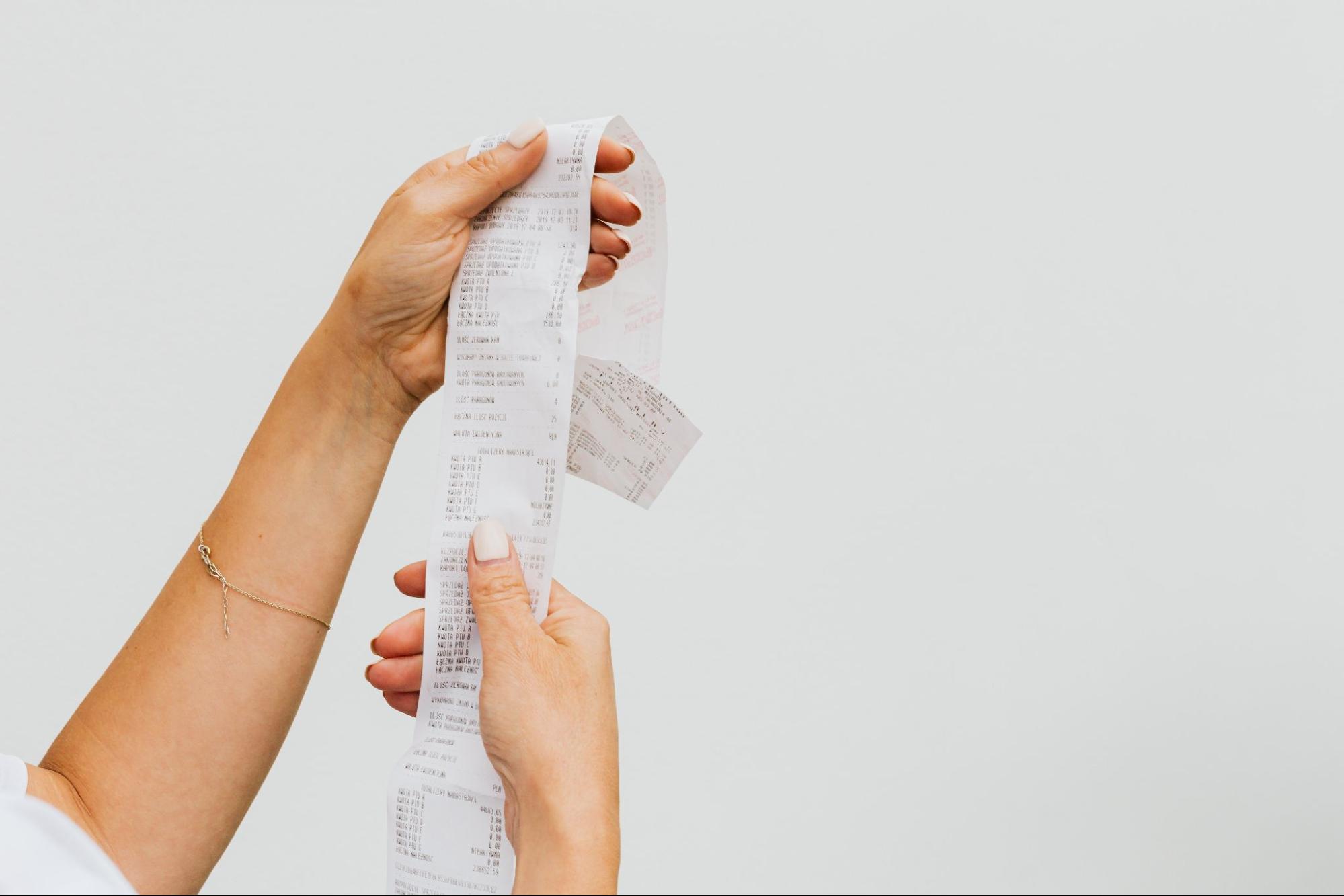

Discretionary spending refers to the money that we choose to spend on non-essential items and activities. It is the amount of our income that is left over after taking care of our necessary expenses, such as housing, utilities, groceries, and transportation.

An example of discretionary spending is dining out at restaurants. While it is not necessary for our survival, it is a way to enjoy a meal that we did not prepare ourselves. Other examples include going to the movies, buying new clothes, or taking a vacation. These are all expenses that we have the discretion to choose whether or not to spend our money on.

Discretionary spending plays a significant role in our personal finances. It allows us to have some flexibility and enjoyment in our lives. However, it is important to strike a balance between indulging in discretionary spending and maintaining financial stability.

When we overspend on discretionary items, it can lead to financial stress and debt. It’s essential to be mindful of our discretionary spending habits and make smart choices with our money. Here are a few tips to effectively manage discretionary spending:

- Create a budget: Set limits on how much you can spend on non-essential items each month.

- Prioritize your spending: Identify what truly brings you joy and allocate your discretionary funds accordingly.

- Track your expenses: Keep a record of your discretionary spending to understand where your money is going.

- Look for alternatives: Find ways to enjoy similar experiences or items at a lower cost, such as cooking at home instead of dining out or shopping at thrift stores.

By being mindful of our discretionary spending and making intentional choices, we can enjoy the things that bring us happiness without compromising our financial well-being.

Why is discretionary spending important?

Discretionary spending plays a significant role in our personal finances, allowing us to enjoy the finer things in life and indulge in activities that bring us joy. It is the freedom to spend our hard-earned money on non-essential items and experiences that make life more fulfilling. Here’s why discretionary spending is important:

- Quality of life: Discretionary spending allows us to enhance our quality of life by engaging in activities that bring us happiness and fulfillment. Whether it’s treating ourselves to a fancy dinner at a new restaurant or taking a well-deserved vacation, these experiences contribute to our overall well-being and satisfaction.

- Self-expression and creativity: Discretionary spending provides us with the opportunity to express ourselves and showcase our individuality. Whether it’s through fashion, home decor, or hobbies, discretionary spending allows us to personalize our surroundings and explore our passions.

- Work-life balance: Engaging in discretionary spending activities helps us find a balance between work and leisure. It serves as a reminder that life is not just about work and responsibilities, but also about enjoying the fruits of our labor. By allocating a portion of our income to discretionary spending, we prioritize self-care and relaxation.

- Supporting the economy: Discretionary spending plays a crucial role in supporting local businesses and the overall economy. When we spend on non-essential items, we contribute to job creation and economic growth. Our spending habits have a ripple effect, benefitting not only ourselves but also the communities we live in.

- Boosting mental well-being: Engaging in discretionary spending activities can have positive effects on our mental well-being. Treating ourselves to small indulgences or experiences can provide a sense of joy, excitement, and fulfillment, ultimately contributing to our overall happiness and contentment.

Discretionary spending is important because it allows us to enhance our quality of life, express ourselves, find work-life balance, support the economy, and boost our mental well-being. By being mindful of our discretionary spending and making informed choices, we can enjoy the benefits while maintaining financial stability.